Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Geography

Europe

New short ideas across Europe and the US

In the last 2 weeks, Vision has seen 5 of its active shorts each decline by more than 10% on the day following weak results / guidance. They have also been busy with fresh ideas. Over the past 2 months, Vision has issued 5 new US shorts and 3 new European shorts in the following sectors - consumer, TMT, industrial and healthcare. These shorts are consistent with Vision's goal to supply clients with liquid, non-consensus ideas as they have a median mkt cap of $14bn, median average daily $ vol of $58m and median short interest of 2%. The theses focus on competition, over-estimated or falling TAM, over-capacity, excessive leverage, negative organic growth and the majority trade at a meaningful premium to itself over time or a peer group.

Why are the share prices of Greek banks falling?

Recent weakness relates to investors pricing in steeper ECB rate cuts and lower rates in 2025 and 2026 than both before the central bank's Oct 17th meeting and compared to what banks have plugged in their RoTE guidance. However, ResearchGreece believes the market is overreacting to the potential earnings downgrade. If market expectations materialise, their earnings estimates are facing a 3%-7% downgrade in 2025 and 4%-6% in 2026. While a 40-100bps hit to their 2025-2026 RoTE estimates is not pleasant, it is not game changing either. ResearchGreece estimates P/TBV 2026 multiples at c.0.80x for Alpha and c.0.90x for NBG, Piraeus and Eurobank, implying 30% (NBG) to 90% (Alpha) upside from current levels.

Atlas Copco (ATCO SS) Sweden

Kenneth Lagerborg (VP Financial Solutions, Group Treasurer) purchased €83,000 of Atlas Copco B shares at SEK159.05, increasing his stake by an estimated 75%. This is the largest of his 5 purchases, the highest price he has paid and his first buy for 4 years. His record to date has been good, according to the analysts at Smart Insider. He last bought stock at SEK91.95 in Dec 2020 and it is notable to see him now buying stock 4 years later at a price more than 70% higher. Furthermore, Vagner Da Silva Rego (CEO since 2024, joined 2014) also recently acquired shares. Smart Insider ranks the stock +1 (highest rating).

Ipsos (IPS FP) France

The share price cratered following the release of Q3 results. Analysts put through meaningful though not catastrophic downgrades. In the rush to condemn the revenue growth it is easy to forget an "okay" margin story, the strong finances, decent financial productivity and something of a roll up story. The stake taken by Lac1 is not likely to be overtly activist, but they presumably also still see a decent company at a very cautious share price. The implied to Y3 EBITM ratio is now 27. Willis Welby finds it very easy to see how the share price can double from its current level.

North America

AI driven 10Q / 10K text analysis

Since there are always reasons when companies change the wording in their financial filings, being alerted to these changes allows investors to realise potential risk factors and opportunities before they are reflected in the market. Recent alerts include: 1) General Electric - appears to be rethinking defence demand and associated future growth. 2) MSC Industrial Direct - no more geographic expansion? Additional financing required? 3) Range Resources - changing strategy on capital allocation? 4) AutoNation - stabilising new vehicle unit profitability. 5) Blackstone Mortgage Trust - caution on CECL reserves.

“Contract Assets” have continued their trend upwards, jumping from 41 days to 45 days of sales. “Unbilled fees and costs and contract assets” have seen a huge increase, rising by 50% to $1,017m in the last 9 months. This is a sizeable balance of "unbilled" revenue sitting on the balance sheet and compares to "Advertising and Media" total revenues of c.$2bn in the last quarter. This seems unusual, particularly in the context of the company's claim that “substantially all unbilled fees and costs will be billed within the next 30 days”. Forensic Alpha considers this one of their more important flags in terms of identifying aggressive accounting and it is particularly concerning for OMC given that revenue recognition was one of the "Critical Audit Matters" raised by its auditor.

New CEO Jim Conroy added to Paragon’s research pipeline - Conroy joins ROST from Boot Barn, where he created 640% alpha as CEO since 2012. However, his ManagementTrack Rating of 5.7 is a modest downgrade vs. the outgoing CEO Rentler's MTR of 7.0. Other stats include: Conroy is a "Builder" capital allocator: 70% of career capital allocated towards CapEx (Rentler is a "Capital Returner", allocating 69%+ towards Dividends & Buybacks). Conroy is an "Inconsistent Guidance Forecaster": Beats 49% & Misses 39% of the time (Rentler is a "Guidance Sandbagger": Beats 87% & Misses 7%). He has a low F.L.A.G. Risk Concern and very low historical Earnings Call Q&A Evasiveness (Conroy averaged 10% vs. Rentler's 27% over the last 5 years).

Q3 results exceeded expectations, sparking a 21% surge in share price, but the rally overlooks fundamental flaws, especially in TSLA’s robotaxi business. While Elon Musk envisions fares at $1 per mile with low costs of $0.2 per mile, this assumes his company will dominate the market unchallenged. In reality, TSLA faces intense competition, which could push fares down to $0.4 per mile, reducing gross margins to c.20%. The net result is that Musk is overestimating the size of the revenue opportunity by 2 or 3 orders of magnitude and TSLA’s market share by a similar amount. Richard Windsor believes the share price remains substantially overvalued.

WING shares took a gut punch, falling over 20%, in response to greater-than-expected Q4 SSS moderation. Jeff Farmer thinks the sell-off is materially overdone, highlighting the restaurant company’s fundamental credentials heading into 2025E including 13%+ system unit growth; +MSD% SSS, almost entirely driven by traffic (following +20% SSS in 2024); ~70% cash-on-cash return; 20% EBITDA growth; and 75% FCF conversion. There is no other consumer discretionary company that can match this. Growth investors who have been wanting to add WING to their portfolios, should do so now. Jeff's TP of $370 equates to 38x his 2026E EBITDA estimate of $302m.

GLP-1s and FDA compounding outlook

Aldis Institutional is hosting an ongoing series of small group events with industry contacts and stakeholders on the outlook for US FDA action on compounding GLP-1s. Earlier this year, the FDA announced the end of the shortage of tirzepatide - which would have prevented companies like Hims & Hers Health and LifeMD from producing lower-cost compounded versions. As a result of industry ligation, FDA is reviewing this decision - creating uncertainty for patients seeking to access GLP-1s, telemedicine companies and manufacturers like Novo Nordisk and Eli Lilly. For access to the events or the Aldis content library of past transcripts please contact us for further details.

Following DXCM’s 3Q24 results, BTN flags several areas of concern: 1) Receivables remain very high - it looks like channel stuffing could have pulled some Q4 sales into Q3. DXCM’s revenue forecast will be tough to achieve if receivable growth does not continue in Q4. 2) Deferred revenues are unlikely to help this quarter - having already dropped significantly, if anything, it is likely be a headwind. 3) Rebates remain elevated. 4) Inventory looks too high. 5) Cutting warranties as a source of EPS appears played out - the company’s warranty reserve has been more than cut in half on a days of sales basis in the last few quarters.

Since Shalabh Garg’s initiation in Jan 22, EFN has delivered stellar results, with its share price rising by ~30% annually and its adjusted EPS increasing by ~22%. However, he believes the market is underestimating the extent to which this growth has been driven by exceptional external conditions, particularly the dynamics of the auto industry during and after the pandemic. Shalabh forecasts EFN's Net Rental Revenue will increase by ~10% Y/Y, significantly lower than its recent growth rate of ~25%. The stabilisation in vehicle pricing and the improvement in new vehicle availability will also impact EFN's services revenue, as the age of its fleets normalises and servicing requirements decrease. He downgrades the stock to Sell.

Craig Huber believes the US mortgage market has finally reached the bottom. Mortgage recovery in 2025/26 should be quite robust and cost actions should be very beneficial to EFX's margins. If anything, his assumptions could prove to be conservative assuming mortgage inquiries increase 25% and 20% in 2025 and 2026, respectively, as this results in 2026 inquiry volume that is still over 20% below 2019’s volume levels. His 2024-26 adjusted EPS (ex-intangible amortisation) estimates are $7.36/$10.85/$15.10 vs. consensus forecasts of $7.33/$9.58/$11.81. Craig increases his 12-month TP to $357.

NUE provided weak 4Q24 EPS guidance, sending the shares down -10%. Despite collapsing near-term estimates, the multiple has expanded as investors hope for a mega rebound in 2025, which management continues to encourage, even in the face of deteriorating demand. NUE's bigger problem, however, is supply, where there is currently new supply under construction equivalent to ~7% of total US steel production capacity. OWS sees continued EPS misses alongside the growing realisation among investors that the ~$8.60 now expected for this year might not represent trough, but rather mid-cycle, earnings. OWS believes normalised, mid-cycle earnings power is c.$8 and their TP of $110 represents a generous 15.4x multiple on their now-lowered $7.16 estimate for 2025.

KinNgai Chan continues to believe MPWR is positioned to benefit from the increased power requirement from AI-related xPUs, Server CPUs, and DDR5 DRAM. While he understands investors' concern about the company's future market share in the AI market, he believes it can offset any share loss with market unit growth coupled with content increase. While the Enterprise Data and Storage & Computing end-markets represents the largest growth opportunity for MPWR in 2025, KinNgai's checks also indicate that MPWR will likely gain share in other market verticals. He expects MPWR to outperform Street expectations.

Emerging Markets

Identifying red flags in non-GAAP / non-IFRS metrics

Many companies employ adjusted EPS figures to hide weaknesses in their businesses or manipulate their financial statements. Given the increased prevalence of adjusted EPS, Mithra has designed a course on identifying red flags in non-GAAP / non-IFRS metrics. They highlight the importance of not only monitoring the growth in the divergence between GAAP and non-GAAP figures, but also focus on the drivers of the divergence. The course highlights multiple company and sectors that exhibit such red flags including education companies in China, active acquirors in Latin America, and the global pharmaceutical and distribution supply chain which is now in the midst of agreeing massive settlements in relation the opioid epidemic in the US.

Asia Ex-Japan Funds: Extreme stocks

In this report, Steven Holden screens for stocks at the extreme ends of their positioning or momentum ranges. He synthesizes current and historical data on fund positioning with recent manager activity to accurately assess sentiment for each stock. Stocks in focus this month: High Positioning, Positive Momentum: KE Holdings and Shriram Finance. High Positioning, Negative Momentum: Axis Bank and NARI Technology. Low Positioning, Negative Momentum: Baidu and BOC Hong Kong. Low Positioning, Positive Momentum: Hon Hai Precision Industry and Tenaga Nasional.

Despite Q3 normally being seasonally weak, TRUE delivered another strong EBITDA performance as its network modernisation progressed faster than guided. New Street is confident TRUE can deliver a beat on its full year (EBITDA) guidance which was upgraded last quarter. Service revenue growth continued in the mid-single digit range with broadband picking up too. Importantly, leverage has come down to 4.4x which is below its 2025 target. Across their EM coverage, TRUE remains one of New Street’s top picks with a TP of THB 18 (45% upside).

China: iPhone sales revival comes at a cost

86Research’s latest MNC* report highlights a revival of iPhone sales in China following the new series release, but driven by an unsually large discount. They suggest that this may be signalling a concession Apple must make in the high-end phone market which has been increasingly competitive. Investing in further offline store expansion does not fully address the challenges and they continue to see persistent pressure on the company's market share and profit margin trends.

*86Research's weekly Multinationals in China publication provides dynamic, accurate and reliable economic, competitive and regulatory, on-the-ground, insight from Multinational companies operating in the country. Investors can subscribe separately to MNC.

HKEX is the ultimate way to play a China bull market, according to Erik@YWR. Cash equity trading picks up, companies want to IPO, and futures and options activity surges. Meanwhile, the cost base is relatively fixed. You get an almost complete transmission of revenue growth into earnings. And because HKEX expenses everything and has no capex, the dividend payout ratio is 90%. It is a pure flow through of China capital markets revenues into DPS. During the last China bull market (2003 to 2007) the share price went up 14x. Consensus estimates expect total HKEX earnings growth between 2023 and 2026 of +16%. Erik forecasts it will be +80%.

Cemex (CEMEXCPO MM) Mexico

EM Spreads downgrades Cemex to Market Perform - weaker than expected 3Q24 results, alongside macroeconomic uncertainties in Mexico, dependency on uncertain US-Mexico relations and foreign exchange risk add pressure to the credit story. For EM investors, EM Spreads prefers Cemex 5.20% 2030 bonds, as they are trading wide to the Mexican Sovereign and the EM BBB Index. However, they do not anticipate these notes will outperform in the near term. For US investors, compared to the broader US market and peers within the cement industry, Cemex’s bonds no longer appear compelling at currently tight spread levels.

Macro Research

Developed Markets

UK: Budget implications

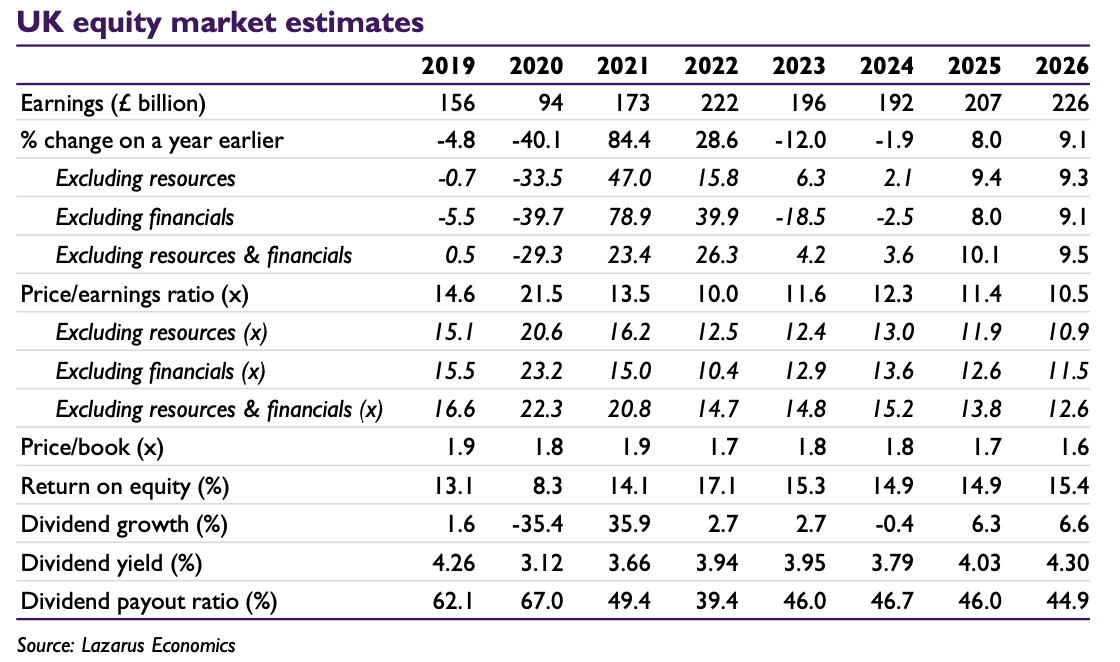

The Autumn Budget 2024 signals higher sustained spending over the medium term than previously planned for. The spending/GDP ratio is projected at 45.25% this year, gradually declining to 44.5% by 2029-30, 5 points above pre-pandemic levels. The budget deficit, currently 4.5% of GDP, is expected to drop to 2.25% by 2029-30, 1 point above the Spring forecast but below the 3% long-term average. Taxes are set to rise from 40.5% in 2023-24 to 42.5% by 2029-30. Darren Winder expects fiscal loosening in the budget to lift demand by just over 0.5% in 2025-26, with real GDP growth reaching 2% in 2025 due to lower interest rates and reduced household savings. Growth should then stabilise at 1.5%, with inflation contained and with minimal impact on gilt yields. In his report, Darren also examines the implications for the UK equity market (see chart).

Georgia’s EU dream ends

The disputed victory of the Georgian Dream party in the country’s parliamentary election on Saturday will put any aspiration of EU membership on ice. Wolfgang Münchau argues that the EU has overreached in its ambition to expand deep into parts of the former Soviet Union, as resistance to EU membership both in Georgia and Moldova is stronger than expected. Wolfgang also notes an interview in Die Zeit with Yulia Navalnaya, the widow of Alexei Navalny, whose views on Ukraine do not chime with naïve western ideas of pro-democracy movements in eastern Europe. Germans were shocked to hear her say that the war would bring Russia together and keep Vladimir Putin in power for longer.

Valuation in a resilient US economy

Goldman Sachs’ bold projection that the next 10 years may be a “lost decade” for stocks, with mere 3% annual returns, is unlikely in the extreme according to Ed Yardeni. It rests on the assumption that valuations in the future will be lower than today’s. Even without expanding valuation multiples, earnings growth would likely boost the S&P 500 price index at a pace that’s at least twice Goldman’s projection, and returns would be more like 11% a year including reinvested dividends. Furthermore, in Ed’s “Roaring 2020s” economic scenario, earnings growth and valuation—and the index’s appreciation potential—would be even greater than that, driven by a technology-led productivity boom.

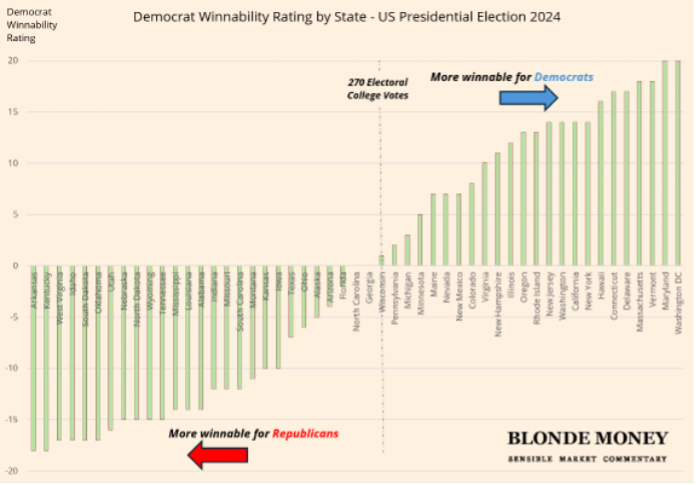

US: Polling is still a dead heat, but Trump is in pole position

Helen Thomas discusses her Democrat Winnability Ranking for each state, where the higher the number, the more winnable the state for Harris. When all electoral college votes for each state are added up, Wisconsin is the finish line. If either candidate takes this state, along with all the others that should be winnable for them, they will emerge the victor. Harris has the harder path to the White House. Her supporters will argue that the polling shows a dead heat; that it all depends on who can get out to vote and that in a game of inches, those putting in the hard yards can still win. Yet, the last-minute substitute is running out of time. Trump was already 1-0 up when Biden resigned and looks set to take the White House trophy next week.

US: Rate optimism collides with capex pessimism

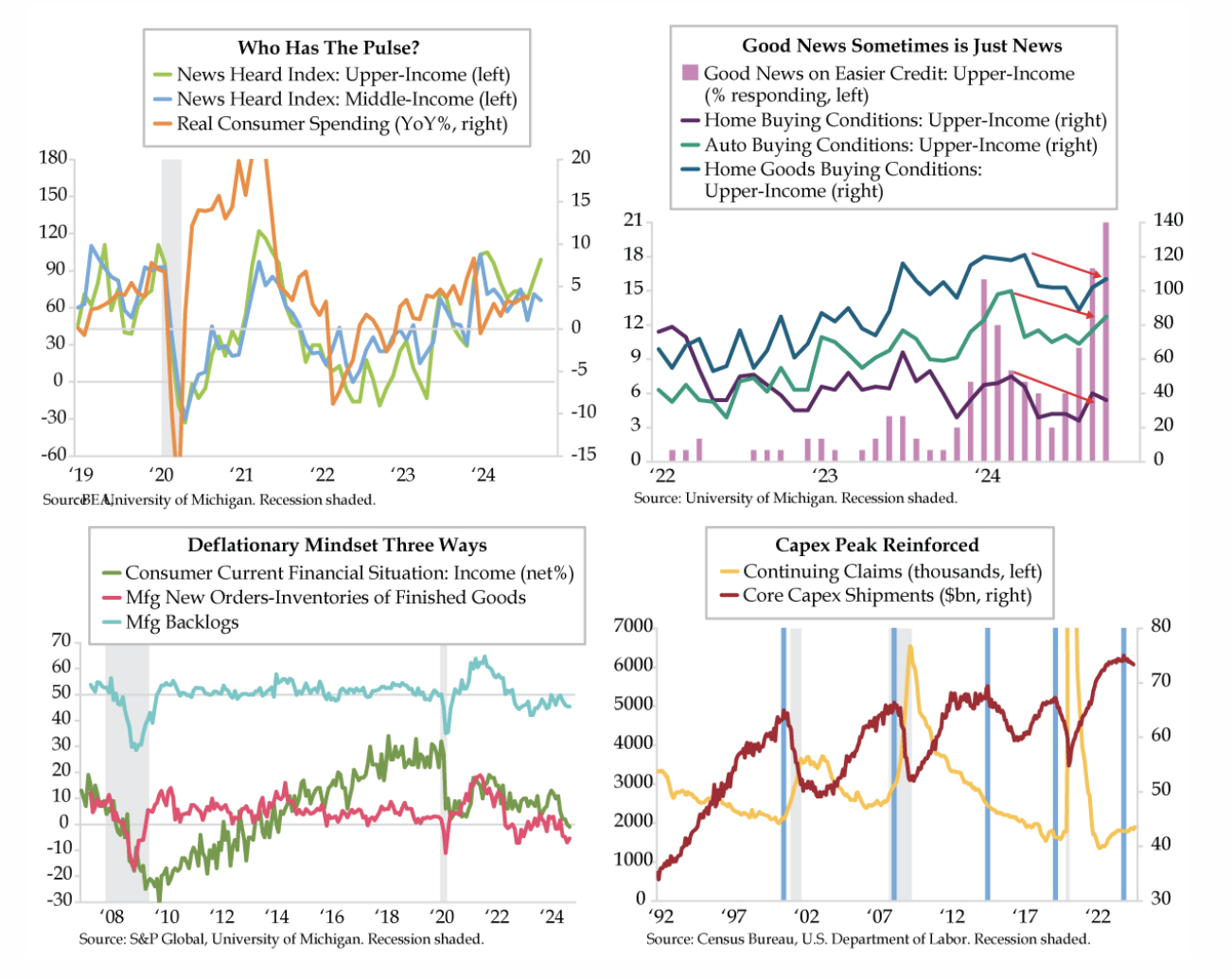

Surging good news about easier credit has improved upper-income households’ collective mood. That optimism has not, however, translated into improved top earners’ big-ticket purchases. Buying conditions for homes, autos, and home goods remain impaired, and households’ current financial situation related to income turned negative for the first time in a decade. A developing deflationary mindset from consumer finances and the factory sector reinforces the peak in capex occurring as the labour market continues to loosen; core capex shipments fell -0.3% MoM in October, below the flat consensus and the sixth loss since January. Investors should be mindful of these fundamental risks for the consumer discretionary cycle.

US: One week to go

With few days remaining until Election Day, the race for the presidency remains deadlocked. Vice President Harris’ lead stands at 1.3 points in 538’s national polling average, down 0.5 points from last week. Such surveys hold little predictive power at this point in the race. Instead, the numbers in the seven battleground states will determine the winner, and these numbers have held fairly steady over the last week. Harris leads by less than a point in polling averages of Michigan, Wisconsin, and Nevada while Trump leads by two points or less in Arizona, Georgia, and North Carolina. Pennsylvania is almost exactly tied. Much of Trump’s gains over the last month have come from his consolidation of undecided Republican voters. There are very few undecided voters remaining. While the presidential race remains little changed over the last few weeks, a number of Senate contests continue to tighten.

US election: The impact on healthcare

With US Election Day quickly approaching and wide-spread readthrough across multiple healthcare sectors, Aldis Institutional hosted a series of election-focused events with leading Democratic and Republican healthcare strategists. Topics included the 2025 Agenda - impact on hospitals, ACA subsidies, Managed Care/Medicare Advantage, Medicaid, dialysis and medtech. To discuss key takeaways and other Washington-driven healthcare insights please contact us to find out more.

Japan: A short run

On Sunday, Japan’s ruling Liberal Democratic Party (LDP) lost its House majority for the first time since 2009. Prime Minister Ishiba Shigeru will now seek to form a government and the House will likely elect him prime minister in November. Opposition parties are divided amongst themselves and two are open to partial cooperation with the LDP. Niall Ferguson expects Ishiba to form a government on a platform of political reform, dovish fiscal policy and a (potentially unfunded) increase in military spending. The most likely outcomes are an LDP-Komeito-led minority government (40% chance) or a coalition involving some sort of combination of Komeito, Ishin and the DPFP (30%). Ishiba is in a weak position, however, and must generate a better result in the Upper House election in July, or will probably have to resign.

Emerging Markets

China’s economic problems create geopolitical risks abroad

Despite China falling into the middle-income trap, the country has largely forgotten the 2030 strategy designed to counter this problem. Instead, as Paul Hodges explains, policy has focused on debt-fuelled growth, primarily via the property bubble. The over-expansion of the manufacturing sector has seen producer prices fall for two years, with consumer prices also edging closer to negative territory. Deflation will worsen the debt position. Many investors fail to realise the planned Rmb 10trn package is not new stimulus, but mainly a transfer of government money to prop up local government finances. This pain, coupled with the oncoming demographic crisis, will see China aim to divert attention abroad to distract from its issues. Along with restoring relations with Russia, the country continues to expand the Global South group, which it sees as a vehicle for restoring its historical Middle Kingdom role at the centre of global power.

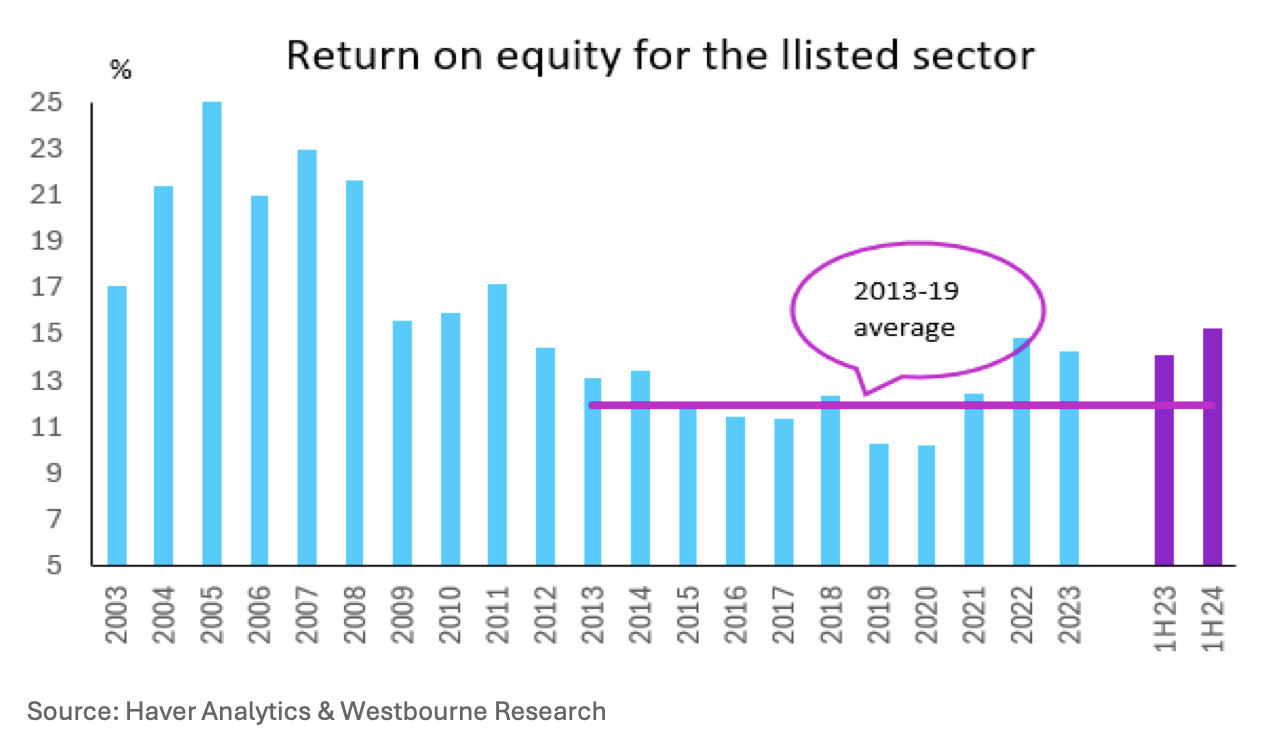

India: Diwali bonus

Sharmila Whelan’s latest report dives deep into India’s economy. Business cycle indicators are positive, indicating gathering momentum in the economic upswing, with return on equity climbing robustly since the low point in 2020 (see chart). Even though policy rates are high, the real cost of capital remains low. Private capex is rising and the government is pouring money into infrastructure investment. It’s just a matter of time before the investment cycle goes into full upswing. With the tough structural reforms now over (unlike in China), India represents a multi-year investment story for the foreseeable future. Sharmila recommends overweight Indian equities across industrial sectors and government and corporate bonds, unhedged. Rates are expected to stay on hold in 2024. Coupled with a positive economic outlook, robust corporate earnings, responsible fiscal policies, and a favourable adjusted resource gap, support an unhedged FX position.

India: Bullish outlook

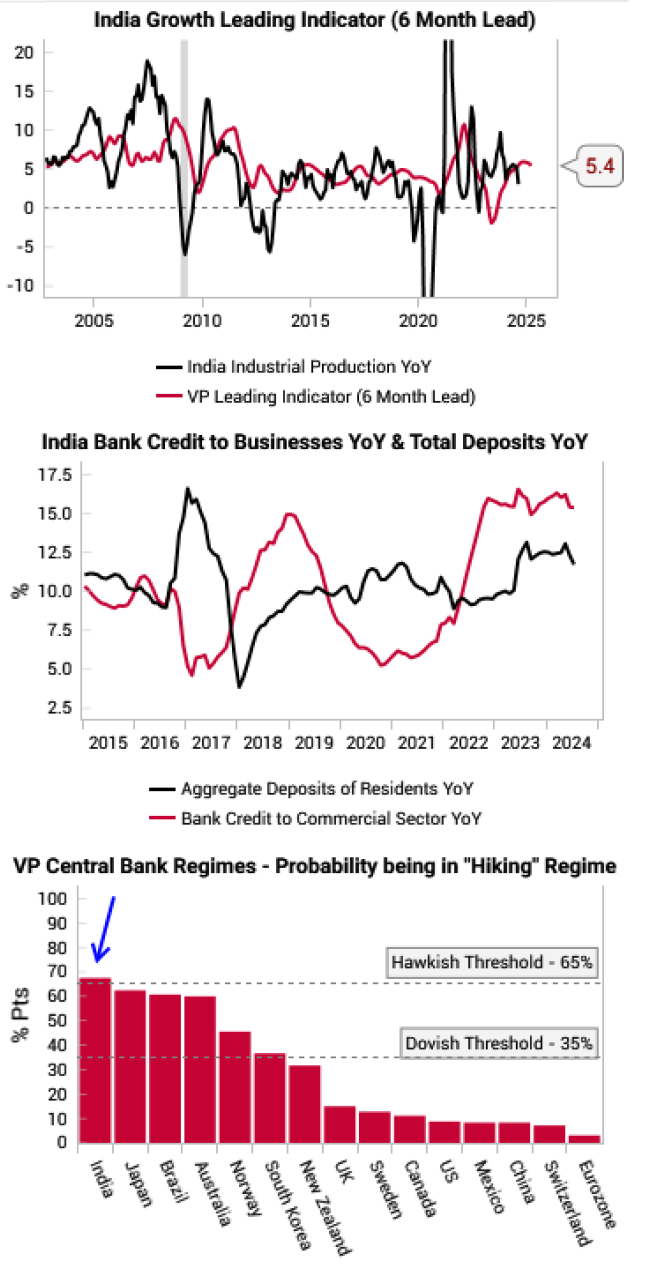

Variant Perception’s India growth LEI remains at a high level (chart 1), while bank credit to businesses in India continues to grow in the high double digits (chart 2). This is aligned with a private sector capex cycle. The RBI has found that fundraising for new projects is surging and expected to rise by 54% from last year. The RBI is now ranked as the most hawkish central bank across DM and EM according to the team’s policy regime models (chart 3). The team like selling rallies on CNHINR to express the bullish growth outlook for India and their medium-term FX edge models also agree. Short CNH vs long INR offers positive carry while Chinese capital leakage pressures remain. However, given the slew of fiscal policy announcements expected from China over the rest of the year, we anticipate a better entry point to short CNH vs long INR.

Bolivia: Are we still here?

The government is still holding onto the bolivano peg despite having run out of FX reserves, via a painful hodgepodge of shortages, controls and emergency borrowing. This can't go on forever, especially as Bolivia continues to run large twin deficits, and just as in Argentina, Egypt, Nigeria, Turkey and other recent examples, Jonathan Anderson has little doubt that Bolivia will soon be forced to let the exchange rate go. Obviously, one does not want to be buying local assets in advance of a currency collapse, and while Jonathan sees underlying value in the dollar sovereign, he prefers to wait until FX adjustment occurs.

Ghana: How long will parliament’s suspension last?

Speaker of parliament Alban Bagbin suspended the operations of the legislature indefinitely on October 22nd. This comes after he declared four seats in the legislature vacant on October 17th in response to a petition by the main opposition NDC party, which subsequently gained a majority in parliament. While the Supreme Court suspended Bagbin’s ruling, the NDC nonetheless assumed the majority seats in the legislature, prompting confrontations with ruling NPP lawmakers. Bagbin subsequently suspended parliament. In their latest update, the Signal Risk team assess how long the suspension might remain in effect and what it could mean, if it is protracted, for broader policy ahead of the December elections.

Uruguay: Orsi faces a tough challenge for round 2

On 27 October Yamandú Orsi of Uruguay’s left-wing opposition Frente Amplio (FA) coalition won most votes in the presidential and legislative elections held the same day. He will face a second-round run-off due on 24 November against Álvaro Delgado, the presidential candidate for the centre-right Partido Nacional (PN, Blancos), the party of President Luis Alberto Lacalle Pou, which heads up the ruling multi-colour coalition. While both remaining presidential candidates have reasons for optimism, the Delgado camp believes the momentum may be swinging in its favour. Its candidate pointed out that the parties of the centre-right coalition collectively secured more votes than those of the FA. 2.7m citizens voted peacefully, with observers highlighting the more moderate tone of the main contenders in contrast to the more polarised nature of other recent elections across the continent.

Commodities

Time to play the natural gas case again?

Houthis shenanigans, unplanned maintenance on Norwegian pipes, the Russia-Ukraine gas transit nearing its end, winter in Europe. Is it time to go long now and watch reality catch up to Habeck and the other ‘Green fanatics’? Not so fast, says Andreas Steno. The bear case is threefold and if prices go closer to 50EUR/MWh it becomes quite compelling. Firstly, stock levels in Europe are 95% full. Refuelling started from super strong levels due to a very benign 2023/24 winter. Add to that Asian LNG demand will deteriorate if prices keep rising, meaning more shipments for Europe as the area can compete more given higher prices. Option markets have driven prices a lot over the past month and is heavily skewed towards the call side (see chart). Andreas reckons that a scenario similar to early 2023 could be playing out again where they have stretched too long and prices fall.

Middle East limbo leaves crude stuck in narrow range

Vandana Hari recently flagged a neutral sentiment on crude in the near-term, expecting Brent futures prices to remain rangebound, averaging between $73-75 for the rest of the month. Their call has proved spot on. They key short-term influences have narrowed down to continued speculation over the next major fallout from the heightened Israel-Iran hostilities, and economic sentiment as a proxy for oil demand, particularly centred on the mood in the US. The big week of November 4th could prove tumultuous, with the presidential election and Fed rate decision falling in the same week. Vandana expects a Trump win to oversee a strategic shift in the Middle East, with Netanyahu offered new options, whereas under a Harris win the crisis will continue to fester.

Will Russian gold flood the market?

In this presentation, Jeffrey Christian of CPM Group discusses the potential impact of Russia selling larger volumes of its gold reserves on the global gold market amid the ongoing conflict with Ukraine. Jeffrey examines the likelihood of this happening the strategic importance of its gold reserves, and the implications for gold prices should a large sale occur. The video concludes with a review of recent price movements for gold and silver, as well as CPM Group's projections for precious metals moving forward.

Click here to watch.